Designation

Chair Accounting and Finance (A&F) and Senior Lecturer of Finance

Staff E-mail Address

pkariuki@kcau.ac.ke

Previous Titles

- COD, Accounting and Finance Department

- COD, Economics and Statistics

- School Examinations Coordinator

Academic Qualification

- PhD Business Administration (Finance) JKUAT 2016

- MBA (Finance) KeMU, 2012

- Ed (Arts); Economics and Mathematics, Moi University, 2005

Membership of Professional Bodies/Associations

Profile

CPA Prof. Peter Kariuki is an Associate Professor of Finance with extensive expertise in financial intermediation, banking efficiency, corporate finance, taxation, and risk management. His research focuses on corporate finance, financial institutions and markets, financial regulation, fintech, sustainability reporting, and investment strategies. He has secured grants from the African Economic Research Consortium (AERC) and The Education Collaborative, Ashesi. Additionally, he led a research consultancy on the level of awareness and extent of counterfeits in Kenya on behalf of the Anti-counterfeit Authority.

With vast experience in curriculum development, postgraduate supervision, and consultancy, Prof. Kariuki has contributed to policy development on anti-counterfeiting, taxation, and financial inclusion. He is an active peer reviewer, an external examiner, and a member of the Institute of Certified Public Accountants of Kenya (ICPAK). Prior to joining KCA University, he served as a Senior Lecturer of Finance and School Examinations Coordinator at the University of Embu.

Selected Publications: Books, Refereed publications & Non Refereed publications

- Lewa, E. M., Gatimbu, K. K., & Kariuki, P. W. (2025). Sustainability reporting in sub-Saharan Africa: Does audit committee diversity and executive compensation matter?. Social Sciences & Humanities Open, 11, 101262. https://doi.org/10.1016/j.ssaho.2024.101262

- Abdulkadir, M., Kariuki, S.N. and Kariuki, P.W. (2024). Ownership structure and financial distress: is the tale from Sub-Saharan Africa different? African Journal of Economic and Management Studies, Vol. ahead-of-print No. ahead-of-print. https://doi.org/10.1108/AJEMS-03-2024-0153.

- Kariuki, P.W. (2024). Market power, human capital efficiency and bank performance in Kenya. African Journal of Economic and Management Studies, ahead-of-print No. ahead-of-print. https://doi.org/10.1108/AJEMS-03-2023-0103.

- Waci J. M., Kariuki, P. W., Mwirigi P. M. (2024) Procurement practices and value for money in State Corporations in Kenya. PLoS ONE 19(6): e0303879. https://doi.org/10.1371/journal.pone.0303879.

- Lewa, E. M., Gatimbu, K. K., & Kariuki, P. W. (2024). Board attributes and sustainability reporting of selected listed nonfinancial firms in Anglophone Sub-Saharan African countries: a multinomial logistic regression. Heliyon. https://www.sciencedirect.com/science/article/pii/S2405844024058559.

- Kinini, D.M., Kariuki, P.W. and Ocharo, K.N. (2024). Capital adequacy, competition and liquidity creation of banks; evidence from Kenya. African Journal of Economic and Management Studies, Vol. 15 No. 3, pp. 440-457. https://doi.org/10.1108/AJEMS-02-2023-0048.

- Kinini, D. M., Ocharo, K. N., & Kariuki, P. W. (2023). Do income diversification and capital adequacy affect liquidity creation? A case study of commercial banks in Kenya. Cogent Business & Management, 10(2), 2240082. https://www.tandfonline.com/doi/pdf/10.1080/23311975.2023.2240082

- Wahinya, P.W., Ondiba, R.O. and Kariuki, P.W. (2023). Competition, risk-taking behaviour and stability of commercial banks: evidence from Kenya. African Journal of Economic and Management Studies, Vol. 14 No. 4, pp. 600-614 https://doi.org/10.1108/AJEMS-03-2022-0123

- Barine N. H., Kariuki S., and Kariuki P. W., (2023). Asset structure, leverage, and value of listed firms: Evidence from Kenya. Investment Management and Financial Innovations, 20(1), 184-194. doi:10.21511/imf20(1).2023.16

- Karugano, R. W., Kariuki, S. N., & Kariuki, P. W. O. (2023). Predictability of GARCH-Type Models in Estimating Stock Returns Volatility. Evidence from Kenya. International Journal of Professional Business Review: Int. J. Prof. Bus. Rev., 8(11), 3. https://doi.org/10.26668/businessreview/2023.v8i11.2813

- Barine N. H., Kariuki S. N., and Kariuki P. W. (2023). The nexus between corporate governance, asset structure, and value of listed firms: evidence from Kenya. Investment Management and Financial Innovations, 20(2), 102-115. doi:10.21511/imfi.20(2).2023.09

- Bita, G. M., Ocharo, K. N., Njagi, Z. M., & Kariuki, P. W., (2022). Relationship Marketing and Customer Satisfaction of Commercial Banks in Kenya. Baltic Journal of Law & Politics, 15(7), 1198-1210.

- Ngure F., Kariuki P., & Mburugu, K., (2022). Macroeconomic Factors and Stock Return of Firms Listed at the Securities. Webology, 19 ( 2), 5526-5543

- Evans, P., Kariuki, P., & Wafula, F. (2022). Effect of Fiscal Policy on Foreign Direct Investment Inflows in Kenya. International Journal of Finance and Accounting, 7(1), 33-59.

- Karitu L., Kariuki S., & Kariuki P. (2022). Revenue Mobilization, Budgetary Controls and Financial Sustainability of Public Universities in Kenya Webology, 19 (3), 2619-2637

- Gitonga, E. N., Kariuki, P. W., & Kariuki, S. N. (2021). Fintech Predictive Modeling and Performance of Investment Firms in Keny Webology, Special Issue on Computing Technology and Information Management, 18.

- Nyakarimi, S. N., Kariuki, S. N., & Kariuki, P. W. (2020). Application of Internal Control System in Fraud Prevention in Banking Sector. International Journal of Scientific & Technology Research, 9 (3), 6524 -6536

- Nyakarimi, S. N., Kariuki, S. N., & Kariuki, P. W. (2020). Financial Statements Manipulations Using Beneish Model and Probit Regression Model. A Case of Banking Sector in Kenya. European Online Journal of Natural and Social Sciences, 9(1), 253.

- Nyakarimi, S. N., Kariuki, S. N., & Kariuki, P. (2020). Risk Assessment and Fraud Prevention in Banking Sector. The Journal of Social Sciences Research, 6(1), 13-20.

- Nyakarimi, S., Kariuki, S. & Kariuki, P. (2019). Moderating Effect of Government Regulations on Internal Control System and Fraud Prevention. A Case of Banking Sector in Kenya. The Journal of Social Sciences Research, 5, (12), 1900-1907,

- Wanjohi, E. N., & Kariuki, P. W. (2019). The relationship between asset allocation and fund performance of occupational pension schemes in Kenya. International Academic Journal of Economics and Finance, 3(4), 47-63.

- Mabeya, H. K., & Kariuki, P. (2019). Effect of financial structure on firm value of non-financial firms listed in Nairobi Securities Exchange; Kenya. The Strategic Journal of Business & Change Management, 6 (2), 1989 –1993.

- Muteti, E. N., & Kariuki, P. (2018). Effect of Investment Criteria on Financial Performance of Private-Equity Firms in Kenya. The Strategic Journal of Business & Change Management, 5(4).

- Lukhoma, B., Kariuki P, & Gichure, J. (2018). Influence Of Board Meetings On Financial Performance Of Sugar Industries In Western Kenya. International Journal of Novel Research in Humanity and Social Sciences, 5( 5), (393-406).

- Njambi, F. N. & Kariuki, P. W. (2018). Effect of mergers and acquisitions on financial performance of financial institutions in Kenya. International Academic Journal of Economics and Finance, 3(1), 64-79

- Kariuki, P. W., (2018). Selected Firm Characteristics and Financial Intermediation Efficiency of Deposit Taking Saving and Credit Co-Operative Societies in Kenya. Journal of Applied Sciences, Engineering and Technology for Development, JASETD, 3 (1), 39-49.

- Kiharo, M. N., & Kariuki, P. W. ( 2018). Corporate Governance Practices and Firm Value of Listed Commercial Banks in Kenya. The International Journal of Business & Management, 6(3), 184-192

- Nguru, K. & Kariuki, P. (2018). Effects of Derivatives on Financial Performance of Firms Listed at the Nairobi Securities Exchange. The International Journal Of Business & Management, 6(4), 50-55

- Malenya, W. & Kariuki, P. (2018). Characteristics of Microfinance Banking Services and Financial Inclusion in Kenya. The Strategic Journal of Business & Change Management, 4(4), 512- 527.

- Kariuki, P. W., (2017). Financial Intermediation Efficiency and Productivity of Deposit Taking Saving and Credit Cooperative Societies in Kenya; a Data Envelopment Analysis. Journal of Emerging Issues in Economics, Finance and Banking, 6(1), 2138 – 2154

- Kariuki, P.W., Muturi, W. M. & Ngugi, P. K., (2016). Asset Quality and Intermediation Efficiency : A study of Deposit Taking Saving and Credit Co-operative Societies in Kenya. Journal of Emerging Issues in Economics, Finance and Banking, 5(2), pp.1843–1859.

- Kariuki, P.W., Muturi, W. M. & Ngugi, P. K., (2016). Profitability and Intermediation Efficiency: Evidence from Deposit Taking Saving and Credit Co-operative Societies in Kenya. International Journal of Economics & Finance, 2(3), pp.215–229.

- Kariuki, P.W., Ngugi, P. K. & Muturi, W. M., (2016). Income Diversification and Intermediation Efficiency : Evidence from Deposit Taking Sacco Societies in Kenya. Research Journal of Finance and Accounting, 7(10), pp.17–26.

- Kariuki, P. W., & Wafula, F. O. (2016). Capital Adequacy and Financial Performance of Deposit Taking Saving and Credit Cooperative Societies in Kenya. The International Journal of Business & Management, 4(9), 20–25.

Research Interest

- Financial intermediation, financial technology, banking efficiency, corporate finance, taxation, and risk management.

Conferences & Chapters

| 20th – 21st July 2023 |

KCAU School of Business Annual Research Conference (SOBARC III).

Paper Presented: Regulatory Capital, Stability and Liquidity Creation among Commercial Banks in Kenya. |

| 11th -12th Oct 2022 |

KCA University Interdisciplinary Conference

Paper Presented: Diversification, Human Capital Efficiency and Bank Performance in Kenya |

| 20th May 2021 |

UoEm, School of Business and Economics Research Dissemination conference

Paper Presented: Capital, Risk, and Efficiency of the Banking Industry in Kenya. |

| 1st -3rd Nov. 2017 |

3rd Dekut International Conference on Science Technology, Innovation & Entrepreneurship-Dean Kimathi University of Technology

Paper Presented: Selected Firm Characteristics and Financial Intermediation Efficiency of Deposit Taking Saving and Credit Co-operative Societies in Kenya. |

Research Grants

| 2024 |

The level and extent of counterfeits in Kenya. Research consultancy services to Anti-Counterfeit Authority (ACA), KES 2,506,254.

Role: Team Leader |

| 2022 |

The Role of Foreign Ownership on the Relationship between Political Uncertainty and Corporate Investments in Africa. Funded by African Economic Research Consortium (AERC) (USD 10,500.00)

Role: Principal Investigator |

| 2022 |

Project IDEAL: Developing Business Ideation Capabilities among University of Embu Students. Funded by the Education Collaborative, Ashesi University (USD 5,000).

Role: Team Member |

| 2020 |

Internal Control System and Fraud Prevention. Funded by the National Research Fund (NRF). Amount KES. 748,350.

Role; Team Member |

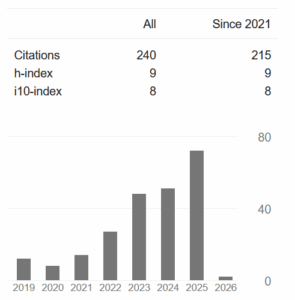

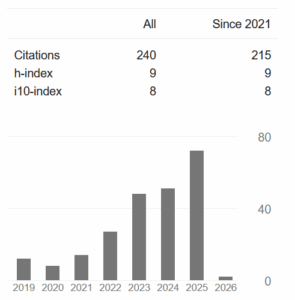

Research Quality

https://scholar.google.com/citations?user=2MFkE5YAAAAJ&hl=en

- Citations 240

- h-index 9

- i10-index 8

Awards and Recognitions

- Recognized at KCA University’s 16th Graduation Ceremony (2024) for outstanding research and innovation contributions.

- Ranked 956th in Kenya’s Top 1000 Scientists (AD Scientific Index, 2022)

Social Media and Academic Networking Tools